If you’ve started browsing home listings online, you may have come across the term “PITI” and wondered what is included in a mortgage payment. PITI stands for Principal, Interest, Taxes, and Insurance — the four parts that make up a typical mortgage payment.

Let’s take a closer look at each:

Principal

This is simply the money you borrowed. If you take out a $100,000 loan, that’s your $100,000 principal.

Interest

Interest is the cost of borrowing that money — basically what the lender charges you on top of the principal.

Taxes

Property taxes fund things like local schools, road maintenance, and other community services. When you have a mortgage, your property taxes are usually included in your monthly payment.

Insurance

Would you rather watch a video than read?

There are two types of insurance commonly included in your payment:

Homeowners Insurance

(also called hazard insurance) protects your home in case of fire, storms, or other major damage. If you have a mortgage, your lender will require that you keep this policy active to protect their collateral — and your investment.

Mortgage Insurance

(often called PMI) protects the lender if you have less than a 20% down payment. Lenders require it because, in the event of a foreclosure, a distressed home often sells for about 80% of its original price. Mortgage insurance helps cover that potential shortfall. For more information about mortgage insurance you can check out the Consumer Financial Protection Bureau page about this.

Escrow Account

When you have a mortgage loan, you’ll typically also have an escrow account. Think of it as a special savings account that goes with your loan. Each month, one-twelfth of your property taxes and one-twelfth of your homeowners insurance premium are added to your payment and deposited into that account.

Then, when the bills come due, they’re paid directly from the escrow account — not from your pocket as one large lump sum. This ensures the lender that payments will be made on time, and it’s also more convenient for the homeowner.

Understanding what is included in a mortgage payment is easier when you see how the escrow account works because it consolidates multiple costs into one monthly bill.

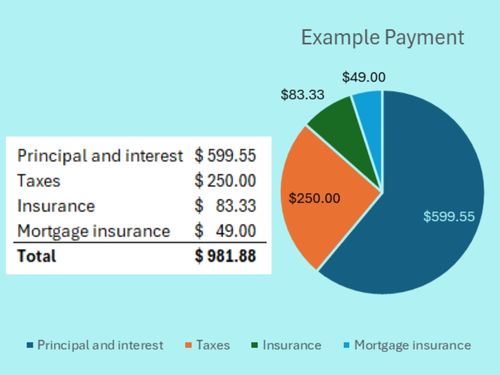

Example: Breaking Down a Mortgage Payment

Let’s say you have a loan with a $100,000 balance at 6% on a 30-year fixed mortgage. The principal and interest are amortized, which simply means your monthly payment stays the same for the entire term of the loan.

In this case, the principal and interest payment would be $599.55.

Now let’s add the other components:

- Property taxes: $3,000 per year = $250 per month

- Homeowners insurance: $1,000 per year = $83.33 per month

- Mortgage insurance (PMI): about $49 per month

So when you add all of that up, your total monthly payment would be $980.43.

As you can see, property taxes and mortgage insurance can have a significant impact on your total monthly payment. Knowing what is included in a mortgage payment can help you better plan your budget and avoid surprises.

In fact, in my post comparing FHA Loans vs. Conventional, I show why FHA mortgage insurance can sometimes give you a lower monthly payment if you’re putting a smaller amount down.

A Quick Trick for Estimating Payments

Here’s the shortcut I promised you.

Without diving too deep into the math, amortization formulas tell us how much we pay per month for each $1,000 borrowed. At 6% interest on a 30-year loan, that number happens to work out to roughly $6 per $1,000 borrowed.

So for a $100,000 loan:

6 × 100 = $600

That gives you a quick estimate of the principal and interest portion of your payment. Just add your estimated monthly taxes and insurance to get a ballpark total.

This trick isn’t exact — it doesn’t include mortgage insurance and it will vary if rates are higher or lower than 6% — but it’s a quick and handy way to see what is included in a mortgage payment and whether a property might fit your budget.

Next Steps

If you want an exact mortgage payment calculation check out my mortgage payment calculator or if you still have questions about your financing options, feel free to reach out to me:

📞 614-502-6834

📧 ronpero@barrettfinancial.com

Understanding what is included in a mortgage payment is an essential step to becoming a confident homebuyer. I hope you found this helpful — and as always, happy home buying!