Are you starting to look into buying your first home? If so, you’ve probably run into the question of which is better when it comes to an FHA loan vs Conventional. Maybe you’ve even heard people say that Conventional is “better” than FHA. But here’s the truth: for many first-time buyers, FHA loans come with advantages that Conventional loans don’t. In this post, we’ll break down the differences between these two popular loan programs and explain why FHA can sometimes be the better choice when buying your first home.

A conventional mortgage loan is the most common type of mortgage loan in the United States. It is what most people think of as a “standard” mortgage loan. A conventional loan works the best for someone who is well established in their job and who has built up at least some liquid assets and who has at least a pretty good credit score.

FHA can be better if you are less well established

For someone who is less well established, maybe because they are just starting out in life with maybe a new career and family and maybe have not had time to save up assets or establish their credit yet. A conventional loan might not be the best fit. For these people, the best alternative is usually an FHA loan. An FHA loan has more relaxed requirements when it comes to credit score. It is also easier to qualify for an FHA loan vs conventional if you have higher debt ratio.

The third most popular loan type is a VA loan. To qualify, you must be a veteran of the armed forces or the spouse of one. Details about VA loans are outside the scope of this video. For more information, visit the official U.S. Department of Veterans Affairs website.

Would You Rather Watch a Video Than Read?

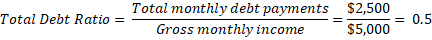

What is Debt Ratio

When lenders evaluate your loan application they look at what is called your debt ratio. There are 2 parts to your debt ratio called your front-end ratio and your back-end ratio or total ratio.

Debt ratio is calculated by dividing your minimum monthly payments into your gross monthly income. The gross income means your income before anything is withheld such as taxes or insurance.

For example, if you earn $60,000 per year your monthly gross would be $5,000. We divided this by the new monthly house payment, say $2,000 to calculate your front-end ratio. In this case that would be 40%.

The back end or total debt ratio would simply be all of the minimum monthly payments plus the new house payment divided into the monthly gross. To continue our example, let’s say you also have a car payment of $200 and a credit card with a minimum monthly payment of $100

| House Payment: | $2,000 |

| Car Payment: | $400 |

| Minimum Credit Card Payment: | $100 |

| Total Monthly Debt Payments | $2,500 |

In this example, the total debt ratio would be 50%.

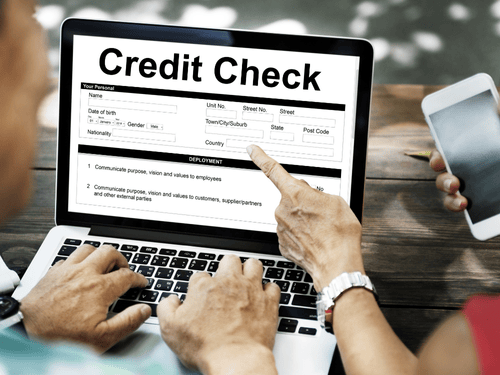

Minimum Credit Score

With a conventional loan, the maximum total debt ratio is about 50% but for an FHA the maximum can go up to 55%. The extra 5% allowed for an FHA can really make a difference for first time buyers with lower income and possibly more monthly payments as they are just starting out.

The minimum credit score needed to qualify for a conventional loan is at least a 620. Some lenders set the minimum as high as 640. On the other hand, the minimum credit score to qualify for an FHA loan is technically 500 vs 620 or even higher for a conventional based on FHA rules, but there’s a catch. If your score is between 500 and 579, you need at least a 10% down payment to qualify. Even though FHA will go down to 500 most lenders set the minimum at 580.

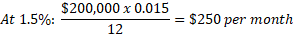

How mortgage insurance works

If you have less than a 20% equity stake in the property with a conventional loan, the lender will require you to have what is called private mortgage insurance or PMI. I cover mortgage insurance in depth in another post titled What is PMI and is it Worth it. This insurance protects the lender if the borrower defaults on the loan. It is necessary because a distressed house often sells for only about 80% of the peak market value.

Ideally, the goal with a conventional loan is to establish a 20% equity position. This can happen either by paying down the loan, by the house appreciating in value, or through a combination of both. Once a borrower reaches 20% equity and is in good standing with loan repayments, they can request to have the PMI canceled.

The minimum down payment for a conventional loan is 3%, which is lower than the FHA’s 3.5% minimum. However, there is a big difference in how mortgage insurance works with a conventional compared to an FHA

Mortgage insurance on a conventional loan is called Private Mortgage Insurance or PMI. It is usually included in the monthly payment and is priced individually for each borrower. Factors like credit score, down payment percentage, and other elements determine the rate.

PMI rates typically range from 0.3% to 1.5% of the original loan amount per year. (To calculate it: multiply 0.015 by the mortgage balance, then divide by 12 to get the monthly amount.) For instance, on a $200,000 loan:

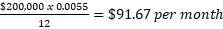

With an FHA loan, mortgage insurance has two parts: an upfront premium and a monthly premium vs a conventional where it is usually all paid monthly. The upfront portion—called the Upfront Mortgage Insurance Premium (UFMIP)—is currently 1.75% of the loan amount and is usually rolled into the loan, so you don’t pay it out of pocket. The monthly portion is about 0.55% of the mortgage balance per year. For example, on a $200,000 loan:

Because the mortgage insurance for a conventional is part of the monthly payment and because the amount varies depending on the borrower’s equity position, if you’re only putting 3% down, the PMI for a conventional can sometimes be more than double what you would pay for an FHA loan each month.

This difference is one of the biggest reasons why an FHA loan can be a better choice for a first-time buyer who is putting down the minimum compared to a conventional loan.

With an FHA loan, the rules are more relaxed regarding minimum credit score and maximum debt ratio, and underwriters tend to be more forgiving overall. For example, the waiting period after a Chapter 7 bankruptcy is only 2 years for FHA loans, compared to 4 years for conventional loans.

However, there are two notable exceptions when it comes to qualifying for an FHA loan:

- Borrowers who are non-permanent resident aliens or foreign nationals cannot qualify for an FHA loan as of May 2025.

- Borrowers with a strong work history and solid assets but little or no credit history meaning they do not have a credit score may still qualify for a conventional mortgage but cannot qualify for an FHA loan.

Differences in the Appraisal

When you buy a house you always need an appraisal which is just a professional opinion of what the house is worth. Conventional appraisals focus almost exclusively on the value of the property. Beyond ensuring basic habitability, the appraisal’s purpose is simply to confirm that the house is worth the sales price.

Because FHA loans are specifically designed for first-time homebuyers, the appraisal process is intended to protect the buyer by ensuring the property is safe and structurally sound. For this reason, an FHA appraisal is more detailed than a conventional appraisal, covering:

- Major structures, including the roof and foundation

- Mechanical systems such as plumbing, electrical, and HVAC

- Interior condition, including carpet quality, paint, and handrails on stairs

While the FHA appraisal is thorough, it does not replace a full home inspection.

Although the FHA appraisal does provide added protection for first-time buyers, sellers often see it as another hurdle to closing. For this reason, sellers may prefer conventional offers, especially in competitive markets.

Additionally, sellers sometimes perceive conventional buyers as stronger or better qualified, which can make a conventional offer more appealing. This usually only comes into play in a hot market where the seller has received multiple offers.

Summary

So to summarize, FHA loans are specifically designed for first-time homebuyers. They address common challenges these buyers face by:

- Accepting lower credit scores

- Shortening the waiting period after a bankruptcy

- Allowing for higher debt-to-income ratios

There are tradeoffs for these benefits, but for many first-time buyers, these tradeoffs are well worth it, especially when they make the difference between getting approved or not.

On the other hand, if do you have higher credit scores, stronger income, and better assets, or if you aren’t a first-time buyer, an FHA loan may not make sense because you will always have mortgage insurance, and the FHA appraisal could make your offer less appealing to a seller compared to a conventional offer.

Hopefully by now it is clear that which option is better for you depends on many factors including your credit, income, savings, and goals. You can learn more specifics about FHA Loans vs Conventional loans on the dedicated product pages for each.

Deciding which loan program is best for you often requires professional guidance. A mortgage loan officer can apply their experience and expertise to your specific situation to help determine which loan program makes the most sense.

If you still have questions not covered in this post, please email me at ronpero@barrettfinancial.com or call me at 614-502-6834. I’m happy to help you navigate your options. As always best of luck and happy home buying!