3 Great First Time Home Buyer Programs in Ohio to buy with 0 down

Despite what you may have heard, it’s still possible to buy a home in 2025 with zero down. These three great programs can help make homeownership a reality—no large savings required.

NMLS id# 1599243

Your Mortgage Expert Since 2001. Let’s Find Your Perfect Loan Together.

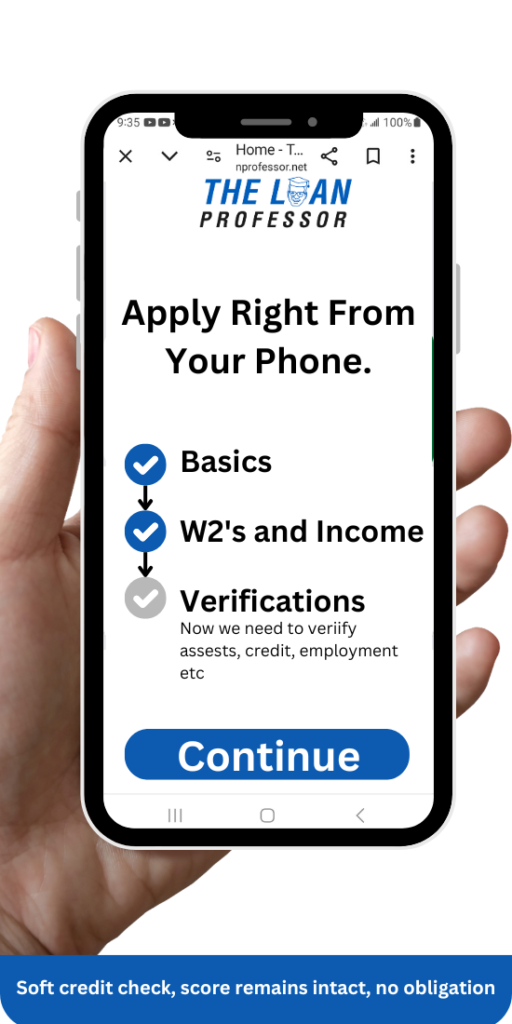

Soft pull, no score drop, no obligation — from a trusted mortgage broker in Columbus, Ohio.

Despite what you may have heard, it’s still possible to buy a home in 2025 with zero down. These three great programs can help make homeownership a reality—no large savings required.

If you’re a first-time homebuyer, you’ve likely started exploring the homebuying process and encountered a variety of terms, one of which might be PMI. But what exactly is PMI, and is it something you need? More importantly, is it worth it?

In this post, we’ll dive into the world of Private Mortgage Insurance (PMI), explaining what it is, why it might be necessary, and how you can determine if it’s a good deal for you. Let’s get started.

If you’re preparing to buy your first home, you might think that the down payment is all you’ll need on closing day. However, it’s a bit more complex than that. In this article, I’ll break down the various components of the cash needed to close, so you can feel relaxed and prepared. Let’s dive in!

We leverage our expertise to craft the perfect loan, tailored to your needs.