What is PMI?

Private Mortgage Insurance (PMI) is an insurance policy that lenders require from borrowers who make a down payment of less than 20% of the home’s purchase price. This insurance protects lenders in case the borrower defaults on the mortgage, allowing the lender to recover their investment. You can learn more at the Consumer Financial Protection Bureau website as well.

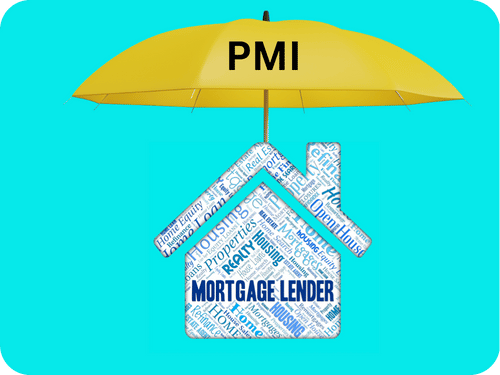

In simple terms, lenders consider it risky to provide a mortgage to someone making a down payment of less than 20%. If the borrower defaults and the lender needs to foreclose on the property, the lender will likely sell the house for less than its original value. In many cases, a foreclosed home sells for only about 80% of its original value. This happens because the lender is not the homeowner or an investor. They only want to get rid of the house. They are not doing all the fixups and spruce ups that cause a house to sell for top dollar. And so, if the house sells for this lower price and the outstanding loan is higher than 80% of the original value this leaves the lender to face a potential loss.

But the problem is, a lot of people, especially first-time buyers don’t have 20% of the purchase price saved to put down as a down payment. And so, to fill in the gap that this creates companies came along who offer special insurance which protects the lender from this risk. This is called Private Mortgage Insurance or PMI.

How Does PMI Work?

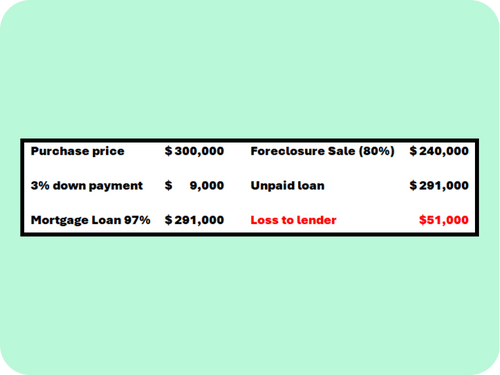

Let’s break it down with an example. Imagine you’re buying a house for $300,000 and you make a 3% down payment of $9,000. This leaves you with a mortgage loan of $291,000, which is 97% of the home’s purchase price. Now, if the lender forecloses on the home and sells it, they might only get 80% of the original value, or $240,000. In this case, the lender would lose the difference between the $291,000 loan amount and the $240,000 sale price, which is $51,000. In that case the PMI reimburses the lender for the loss.

Who Pays for PMI?

As you might have guessed, the borrower pays for PMI. The annual premium is divided into 12 and added to the monthly mortgage payment.

Even though it adds to your monthly mortgage payment, PMI can be beneficial because it allows you to buy a home with a smaller down payment, often as low as 3% or 5%.

The good news is that with a conventional loan, PMI can usually be canceled once your loan balance falls below 80% of the home’s appraised value. This could happen because the home appreciates in value, you pay down the mortgage balance, or a combination of both.

Is PMI Worth It?

To determine whether PMI is worth it for your specific situation, it’s helpful to use a calculator.

Below, I’ll walk you through a tool I’ve created that allows you to input your unique scenario and compare the costs of paying PMI versus waiting until you can make a 20% down payment.

Using the PMI Calculator

Here’s a quick overview of how to use my PMI calculator:

- Purchase Price: Enter the price of the home you’re looking to buy. For example, let’s say $250,000.

- Interest Rate: Input the interest rate your loan officer provides you. This could be around 6%.

- Credit Score: Your credit score affects how much you’ll pay for PMI. Enter your current credit score.

- Down Payment Percentage: Input your expected down payment—whether it’s 3%, 5%, 10%, etc.

- Rent Payment: Enter your current monthly rent payment.

- Property Taxes: Estimate the annual property taxes for the home you’re considering. You can find this information on the county auditor’s website or ask your realtor.

- Homeowners Insurance: Input the annual homeowners insurance premium. If you’re unsure, get a quote from your current insurance agent.

- Appreciation Rate: Estimate how much you expect the home to appreciate each year. A conservative estimate might be 2%.

- Saving Timeline: Estimate how long it will take you to save for a 20% down payment. This could be 48 months (4 years) or longer, depending on your savings rate.

Comparing Scenarios

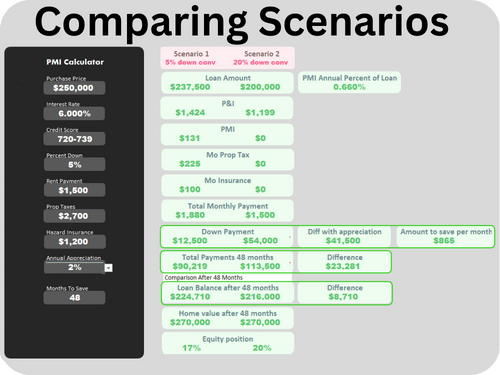

So now, Let’s compare these two scenarios:

- Scenario 1: You buy a $250,000 home today with a 5% down payment. Your loan amount is $237,500, and you’re making monthly payments of $1,880 (including PMI, taxes, and insurance).

- Scenario 2: You save up for 48 months to make a 20% down payment on the same house. After four years, the home’s value has appreciated to $270,000, and your down payment is $54,000. Your new loan amount is $216,000, and your monthly payment is $1,199 (excluding PMI).

In Scenario 1, after 48 months, you’ll have paid approximately $90,219. In Scenario 2, you’ll have saved $865 monthly while continuing to pay $1,500 in rent, totaling $113,000 over the same period.

The difference between the two scenarios is about $23,281.

So, the bottom line is that as the borrower you did come out slightly ahead with scenario 1 where you made the purchase and did have PMI instead of waiting the 4 years and saving up a 20% down payment. Part of the reason for this is due to the fact that in scenario 1 you bought the house 4 years ago and it appreciated in value that whole time whereas if you waited and saved up the down payment, the house still appreciated in value but instead of you gaining that value, you actually had to pay more when you bought the house. To be completely clear, in scenario 2 you did pay more but you did start out with a slightly smaller loan than you would have had under scenario 1 after 4 years. ($216,000 compared to $224,710 in Scenario 1).

Not only did you come out ahead financially in scenario 1 where you bought with a lower down payment and had PMI. You also got to be a homeowner versus a renter for those 4 years. To many people that is the biggest benefit of all.

PMI can be the key to Owning Your Home Sooner.

PMI might seem like an unnecessary expense at first, but it can actually be a valuable tool that allows you to buy a home sooner rather than later. By running the numbers and using tools like the PMI calculator, you can make an informed decision about whether PMI is worth it for your situation.