Many first-time home buyers put off purchasing their first home for one simple reason—they think they don’t have enough money saved for a down payment. But in this article, I’ll walk you through three of the best first time home buyer programs Ohio has to offer that can help cover that cost and make homeownership possible sooner than you might think. In addition to these three programs, you should also check out the special 1% down conventional loan program.

A little bit about the author

Hi, I’m Ron Pero. I started as a mortgage loan officer back in 2001, and I apply what I’ve learned over the past 25 years to help folks make home buying easier and less stressful—even when they think it’s out of reach.

Here’s the good news: there are at least three great ways for someone with little or no savings to still buy a home—right now. In this article, I’ll break down the top three options that make this possible—along with who qualifies, how much you can save, and how to take the first step.

As a mortgage broker with access to more than 100 lending sources, it’s my job to scour all the available first-time home buyer assistance programs to find the best options for today’s first-time buyers. Through my analysis, I’ve come across several good options—but in my opinion, these are three of the best firsttime home buyer programs for most people. If you’d like a broader overview of loan programs in general, click here to learn about the 9 most common loan products used by today’s buyers.

These low income home buying programs all work well for the average buyer with at least a good credit score. As long as you plan to live in the property as your primary residence, you can use these programs. You don’t need to be a veteran or hold a special occupation like doctor or firefighter — anyone with decent credit can qualify. Not sure how much house you can afford? Try our Mortgage Payment Calculator to estimate your monthly payment.

Why 0% Down Matters

Let me be clear: when it comes to buying a house, there’s no free lunch. The best interest rates and lowest monthly payments will always go to those who can put down the minimum FHA requirement of 3.5% of the purchase price.

A 3.5% down payment gets you what’s called the “market rate,” which is the lowest available FHA loan rate on the day you lock in. But some buyers simply don’t have that 3.5% saved up.

For these buyers, the next best option is to use a firsttime home buyer program that provides the 3.5% down payment for you. To qualify, you’ll need at least a 620 FICO score, and as mentioned earlier, you must plan to live in the home as your primary residence. Other than that, you’ll just need to meet the standard FHA loan requirements. You can learn more about FHA loan guidelines and down payment options on the U.S. Department of Housing and Urban Development’s website.

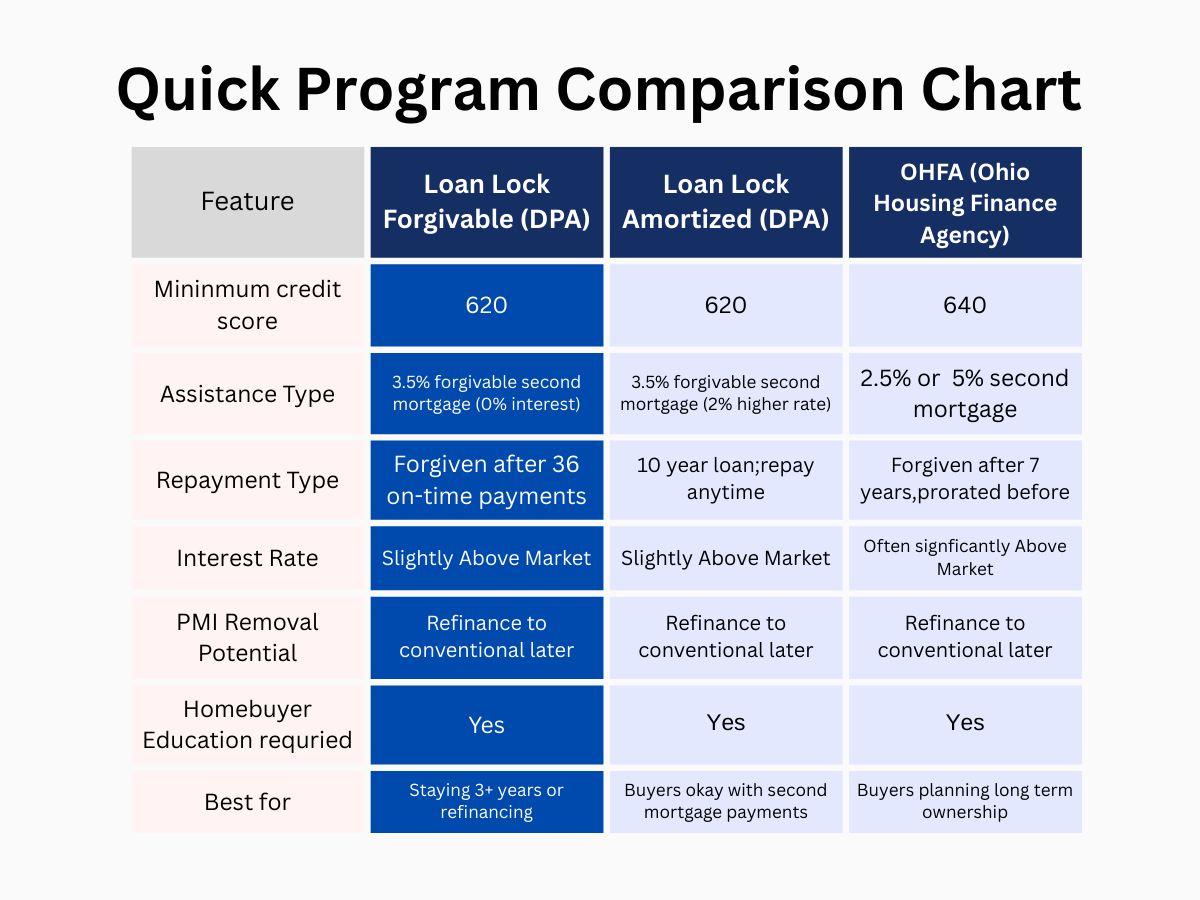

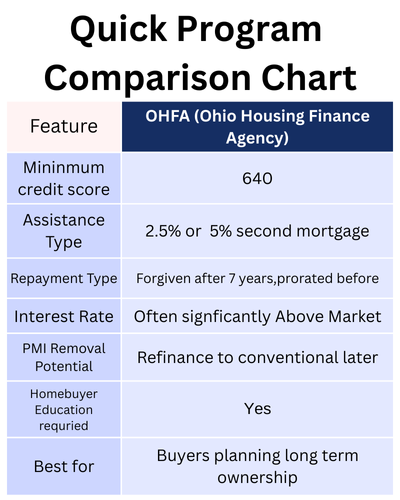

1. OHFA – A Top First Time Home Buyer Program Ohio Buyers Shouldn’t Miss

One of the most popular firsttime home buyer programs in Ohio is the OHFA program, administered by the The Ohio Housing Finance Agency (OHFA) provides down payment assistance to qualifying homebuyers with a minimum credit score of 640. Their Your Choice! program offers a second mortgage equal to either 2.5% or 5% of the purchase price:

- If you receive 2.5%, you’ll need to bring in the remaining 1% to meet the 3.5% down payment requirement, plus your closing costs.

- If you qualify for the 5%, it can cover the full 3.5% down payment and up to 1.5% of your closing costs.

The interest rate on the first mortgage through OHFA is typically about 1% higher than the market rate. The second mortgage is forgiven after 7 years—so if you stay in the home that long, you won’t have to repay it. If you refinance or sell before then, the repayment is prorated based on how long you lived there.

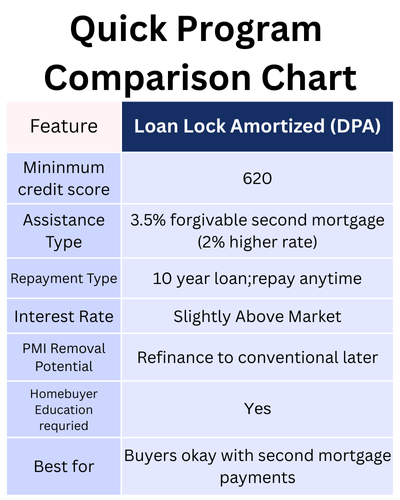

2. Loan Lock Prime 10-Year Mortgage Program for First-Time Buyers

For this firsttime home buyer program, you’ll need at least a 620 credit score. The lender issues a second mortgage equal to 3.5% of the purchase price, covering the full FHA down payment.

The second mortgage has an interest rate 2% higher than the first mortgage. For example, if your first mortgage rate is 7.75%, the second would be 9.75%. The second mortgage is amortized over 10 years and paid monthly along with your first mortgage—creating one combined payment.

The main advantage of this first homebuyer program is flexibility: there’s no forgivable portion, so you can refinance or sell at any time without penalty. Plus, the first mortgage rate is slightly lower compared to the OHFA program.

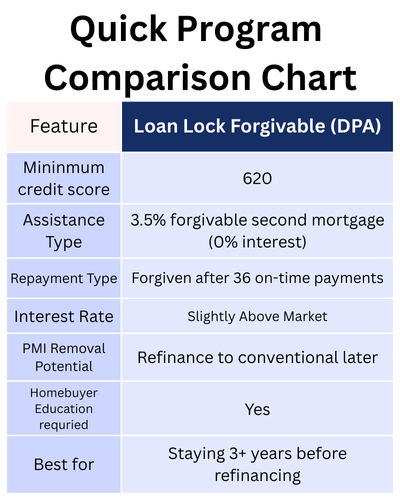

3. Loan Lock Prime 3-Year Forgivable Loan (My Favorite First-Time Buyer Program)

This is my favorite option. It also provides a second mortgage which covers the required 3.5% minimum down payment for a first-time home buyer purchasing a house, but after 36 on-time payments, the second mortgage is completely forgiven. Learn more about this program here.

The interest rate is similar to OHFA—about 1% to 1.5% above market. However, the second mortgage carries 0% interest and no monthly payment. There is no prorated forgiveness: once you hit the 36th payment, the entire second mortgage is wiped out. But if you refinance, sell, or move out before then, you’ll owe the full amount of the second mortgage.

Comparison of Ohio’s Top 3 First-Time Home Buyer Programs

First Time Home Buyer Programs in Ohio Require Education

For all three programs, buyers must complete a first-time homebuyer education course. These courses can be completed online or in-person at various locations across Ohio. To find approved classes and get started, visit the Ohio First-Time Homebuyer Education website.

A Few Basics About Home Finance.

In order to make all of these numbers make a little bit more sense, I think it might be helpful to briefly explain how a home purchase works.

When you buy a house, every loan program has a minimum down payment requirement. For example, an FHA loan requires the borrower to put down at least 3.5% of the purchase price. A conventional loan down payment can require as little as 3%, but also may require 5% or 10%. PMI, or private mortgage insurance, is higher with a conventional loan the lower the down payment is.

In addition to the down payment, the borrower also must pay closing costs to various vendors involved in the approval process—such as the lender, appraiser, home inspector, etc. These costs vary depending on how the loan is structured.

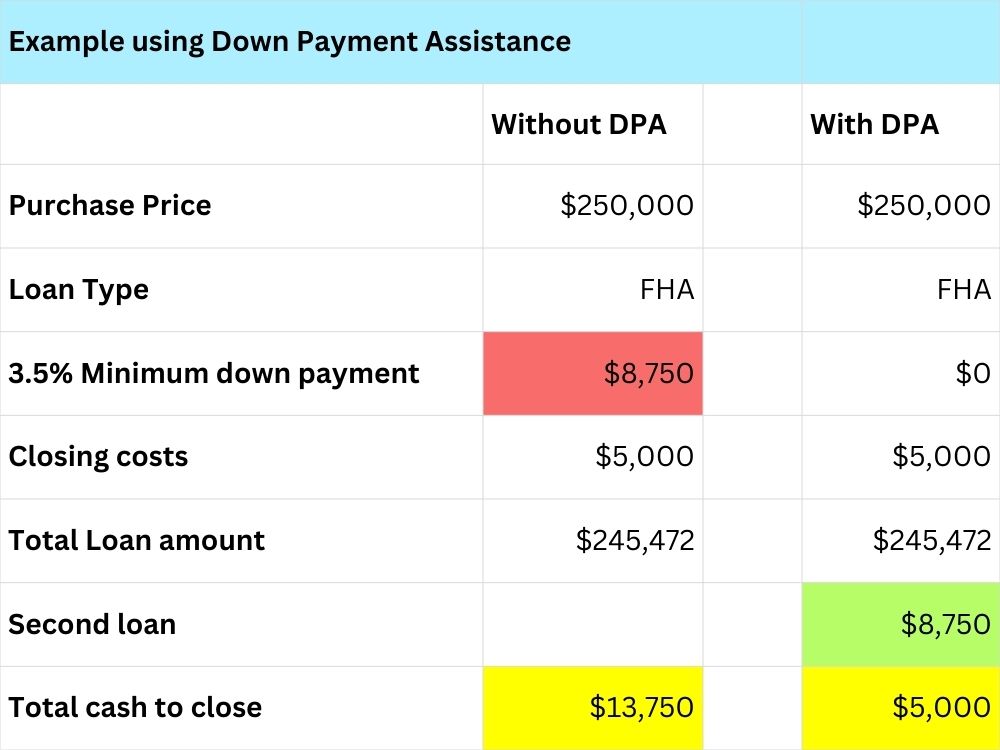

Hypothetical Example with and without Firsttime Home Buyer Program

Let’s say a buyer is purchasing a home for $250,000 with an FHA loan. They’ll need to bring a 3.5% down payment, or $8,750, plus closing costs of around $5,000. That means the total cash required is about $13,750 ($8,750 down + $5,000 in closing costs).

What these down payment home buyers programs do is provide that minimum required 3.5% down payment. A buyer can negotiate for the seller to pay up to 6% of the purchase price toward closing costs, but the seller cannot pay the minimum required down payment. The only way to finance the down payment is with a special program like the ones outlined here.

I understand this may still seem a bit confusing—especially if you’re new to the process. If so, the best next step is to meet with me over Zoom or in my office. We can walk through the numbers together and make everything crystal clear.

Conclusion

As I mentioned at the outset, if you do have the minimum 3.5% down payment available, it often makes the most sense to apply it toward the purchase in order to get the lowest possible rate. But if you don’t, these programs can be a great solution to make homeownership possible for you in 2025. If you’re ready to take the next step, click here to start your application now.