How Can I know if I’m getting a Good Deal?

Are you wondering about all these fees? Does every lender charge them? Is this a good deal? Where do you even start? Don’t worry. In less than ten minutes, I’ll show you an easy way to figure out How to compare mortgage offers so you can confidently shop for a mortgage loan and ensure you’re getting the best deal.

Navigating and understanding closing costs for a mortgage loan can be confusing and overwhelming. After all, you want to get the best deal and avoid high fees and closing costs. With so many numbers and figures, it can seem complicated.

It comes down to more than just the rate!

Many people focus solely on finding the lowest possible interest rate without considering the fees the lender might charge. As a result, they end up paying more in fees than necessary.

What can you do? The process of applying for and shopping for a mortgage feels complicated. Each lender charges differently, with many fees having strange names, making it hard to know what’s normal, what’s negotiable, and what’s not.

As mentioned, many people fixate on the interest rate offered by the lender and choose the one with the lowest rate, without focusing on the lender fees.

While an interest rate is a straightforward number, understanding that lender A offers one rate and lender B offers a slightly lower rate, it might seem like a better deal to go just go with lender B.

However, the rate is only part of the story. To truly determine if you’re getting the best deal, you need to consider both the rate and the lender fees.

How can I shop and compare between lenders?

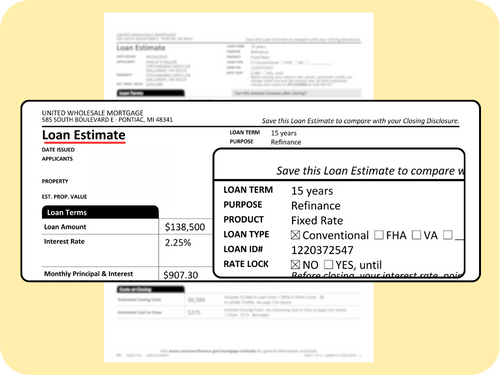

So, how do you know what the lender is actually charging you? The answer lies in a document called the Loan Estimate.

Lenders are required to provide this to you within three business days of your application. The Loan Estimate provides specific details about the loan you’re considering, including the loan amount, interest rate, estimated monthly payment, and closing costs. It also shows the cash you’ll need to bring to the closing table, the loan term, the purpose of the loan (whether it’s a refinance or purchase), and the loan type (conventional, FHA, or VA).

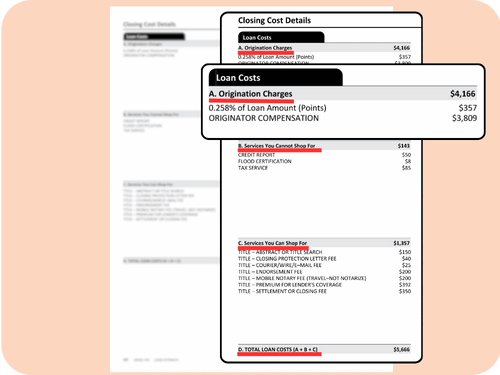

The key section to focus on is page two, specifically the “Closing Cost Details.” This section is divided into two columns. Pay close attention to the left side, which includes sections A, B, C, and D.

- Section D: Summarizes the other sections.

- Section C: Lists services you can shop for.

- Section B: Lists services you cannot shop for.

- Section A: Lists Origination Charges

Items in Sections B and C are highly regulated and standardized, so there’s little room for negotiation.

Always compare Section A of the Loan Estimate!

However, Section A—Origination Charges—is where you’ll find the fees the lender is charging. This section might include charges for buying down the rate (discount points), processing fees, or compensation for the loan officer. These fees are legitimate they show the compensation for the lender but vary these fees do vary from lender to lender.

For example, Lender A might offer a 7% rate with low origination charges, while Lender B might offer a 6% rate but with substantial fees.

How long will you be in this house?

You’ll need to evaluate how long you plan to stay in the house. If you’re only planning to be there for a few years, paying higher fees for a lower rate might not be worth it. In that case even if you do pay slightly more in monthly payment, it still might end up costing you less money because the closing costs were lower.

You are allowed to shop between lenders.

Remember, the Loan Estimate must be provided every time you apply for a loan. By law the Loan Estimate must be sent to you within 3 business days after you make a full loan application.

You can safely apply with two to three different lenders within a short time frame (e.g., 30 days) without negatively impacting your credit score. This allows you to compare Loan Estimates and determine which lender offers the best deal with the best rate and fees.

Conclusion

In conclusion, understanding closing costs and lender fees is crucial for prospective homebuyers. While interest rates are important, they should not be the only factor that you consider.

By scrutinizing Section A of Page Two of the Loan Estimate, you can make informed decisions that align with your financial goals and homeownership plans.

Pay close attention to both the fees and the interest rates. When applying for a mortgage loan, ensure you receive a Loan Estimate within three business days and carefully review Page Two, Section A. By following this advice, you can be confident you’re getting the best deal.

In addition to this, if you want to learn about what is involved when you apply for a mortgage loan check out my 4 step loan process page

I hope you found this information helpful. Happy home buying!