Understanding the Total Cash Required

Hi, everyone! I’m Ron Pero, The Loan Professor. Many buyers are surprised to learn exactly how much cash you need to buy a house, beyond just the down payment. Knowing this upfront can make the process feel much more manageable, especially if your finances are tight.

Would You Rather Watch a Video Than Read?

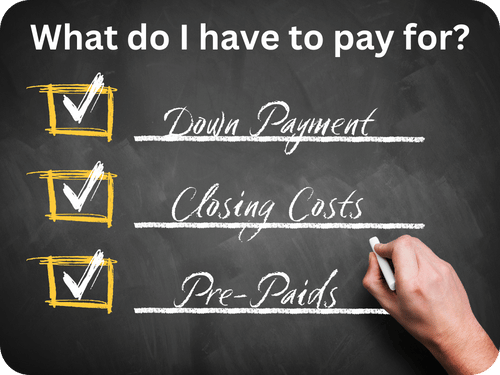

What You’ll Need to Pay For

To recap from a previous video, here are the main costs you should expect:

- Down Payment

- Typically a percentage of the purchase price depending on your loan program.

- Example: FHA loans usually require a 3.5% down payment.

- Closing Costs

- Detailed in the Loan Estimate, which lenders provide within three business days of your application.

- Pre-Paids

- Deposits for an escrow account covering property taxes and homeowner’s insurance.

- Instead of receiving bills directly, the lender collects 1/12th of these amounts monthly.

- After closing, your first mortgage payment is due the month after the first full month post-closing. For example, if you close on October 15, your first payment is due December 1. To fund the escrow account, you’ll deposit two months’ worth of taxes and insurance plus a one-month cushion.

- Pre-Paid Interest

- Interest starts accruing on your loan the day you close.

- If your closing date isn’t the 1st of the month, lenders collect interest for the partial month upfront.

- Appraisal and Mortgage Credit Report

- These are typically paid when you apply for the loan, either by check or credit card. Understanding these costs helps you estimate how much cash you need to buy a house. For more information on appraisals, check out the CFPB site.

- Home Inspection

- Not a closing cost but highly recommended to uncover potential structural issues. Paid directly to the inspector.

- One-Year Homeowner’s Insurance Policy

- Usually purchased through an insurance agent and paid upfront.

- County Charges

- Found at the bottom of page 2 of your Loan Estimate, including conveyance fees (taxes for property transfer) and recording fees for your deed and mortgage.

Credits That Can Reduce Your Cash to Close

You may qualify for certain credits to lower the cash needed:

- Seller Credits

- Covers property taxes from the last payment date to closing.

- Example: Closing in October with taxes due in July? The seller credits the buyer for that period. In Ohio, taxes are paid in arrears, so the buyer also receives a credit for the previous six months.

- Title Insurance

- In Ohio, the seller pays for the lender’s title insurance. You cover a portion, and the seller pays the rest.

- Negotiated Seller Contributions

- FHA buyers can negotiate for the seller to cover up to 6% of the purchase price for closing costs and pre-paids.

- Can also be used to buy down your interest rate but not for the down payment.

- Lender Credits

- Lenders sometimes offer credits that offset pre-paids or closing costs.

- They may present two rate options: one with a credit and one without, useful if you’re short on cash.

Final Thoughts

The home-buying process can feel overwhelming, but having a detailed conversation with your lender about these expenses will make it much clearer. Most buyers appreciate being well-informed — especially when it comes to understanding how much cash you need to buy a house.

Buying a house is exciting, but it can also be stressful. Being financially prepared eases that pressure and makes the experience far more enjoyable.

To learn more about the loan approval process, check out my [4-step loan approval process].

I hope you found this information helpful and now feel confident about how much cash you need to buy a house.

If you have questions not covered in this post, email me at ronpero@barrettfinancial.com or call 614-502-6834. I’m happy to help you navigate your options.

As always, best of luck and happy home buying!